PPOB has emerged as a digital payment innovation by streamlining the bill payment process for consumers. What exactly is PPOB? Although it started in the early 2000s, in today’s digital era, this payment method is increasingly widely used.

Moreover, the rise of smartphones and easier internet access has made cashless transactions faster and more convenient. This is why people increasingly prefer using PPOB, as it offers a more practical and efficient payment method.

Here’s a comprehensive explanation of PPOB, which can also serve as a business idea you can pursue.

What Is PPOB?

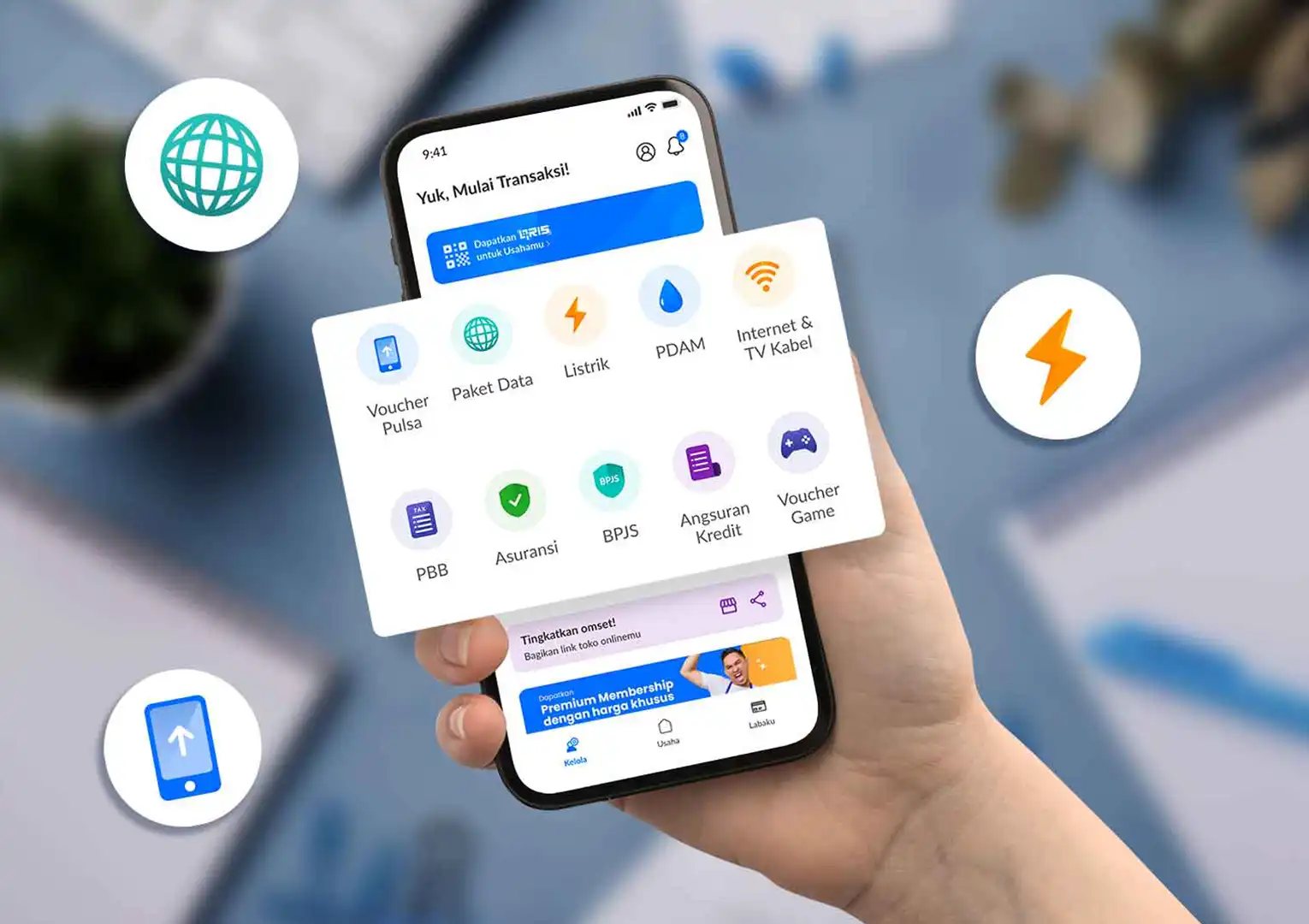

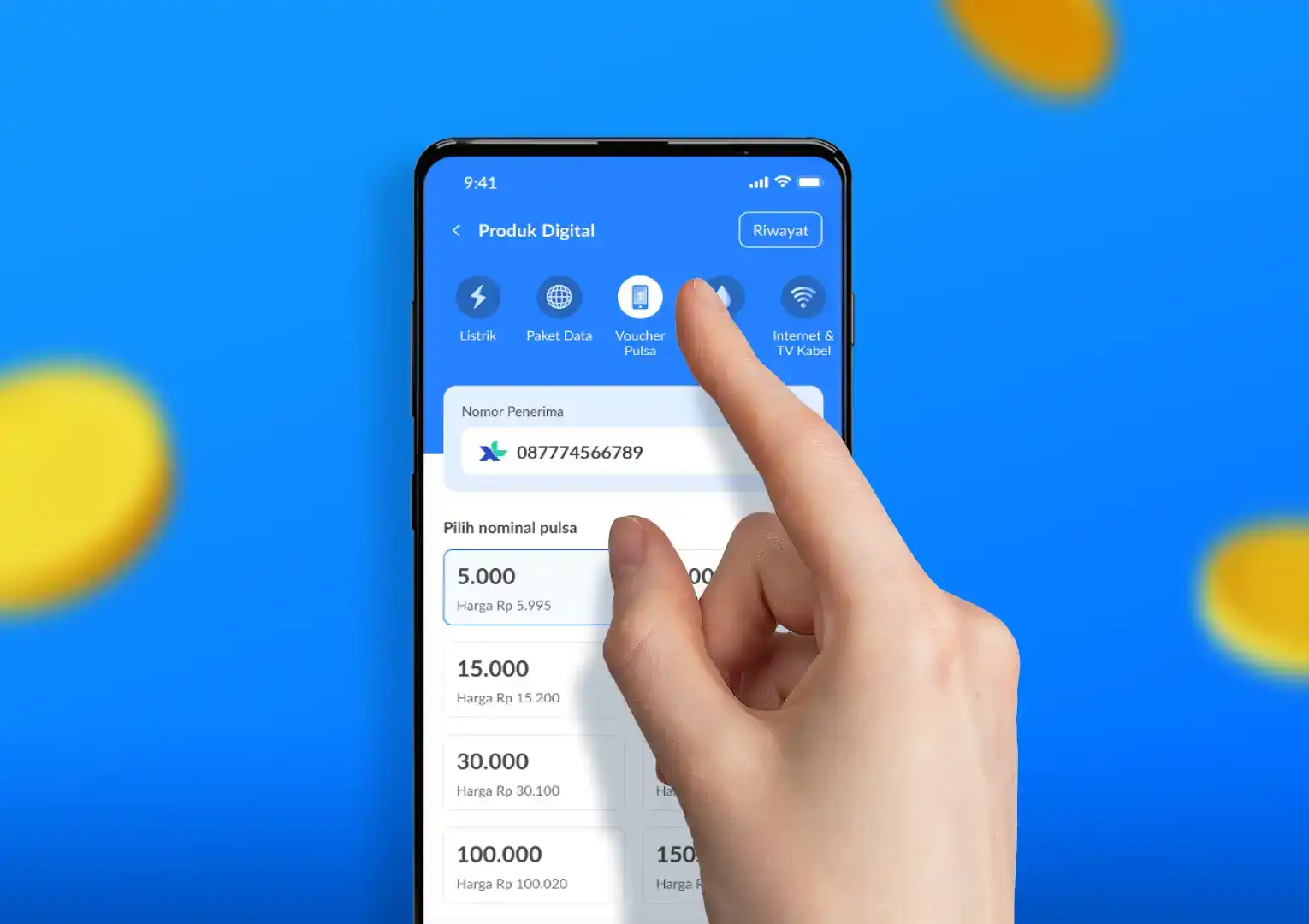

Payment Point Online Bank (PPOB) is an innovation designed to simplify recurring payments such as electricity, internet, telephone, water bills, and many more. This payment method allows people to pay all their bills through a single PPOB outlet.

Although many people find it easier to pay bills online via e-commerce or mobile banking, a significant number of Indonesians still feel more comfortable visiting a registered PPOB outlet in person.

They simply visit a PPOB kiosk or booth to pay various bills, such as electricity, or even purchase transportation tickets like train tickets. This makes PPOB payments easier, simpler, and—most importantly—inclusive for everyone.

How PPOB Works

PPOB operates both offline and online. All data is stored and processed digitally, while transactions are carried out manually. Although it supports online payments, most PPOB customers still prefer to pay in cash.

As an operator, you need to enter all data into the server and make payments using a preloaded deposit. Then, customers will pay you—the operator—using their preferred payment method. Therefore, make sure to top up your deposit regularly to keep the business running smoothly.

As a PPOB owner or operator, your income comes from commissions. Depending on the vendor, you can earn 1%–5% commission on each transaction. This makes PPOB a side business that doesn’t require a large initial investment but offers a reliable source of profit.

Benefits of Becoming a PPOB Business Partner

The shift in consumer behavior toward digital channels has increased demand for online-based products and services. By adapting to these trends, such as becoming a PPOB business partner, you can drive the growth of your digital business. Here are the benefits you’ll gain.

1. Increased Revenue

Partnering with PPOB can help you boost sales of products or services related to payments and billing. This is because customers can make payments more easily, eliminating previous obstacles.

2. Operational Efficiency

You can save on operational costs since there’s no need to manage the payment system independently. All payments can be processed through PPOB.

3. Enhanced Customer Loyalty

By offering payment options through PPOB, you can enhance customer satisfaction due to the ease of transactions. This can boost customer loyalty to the products or services they use.

4. Wider Market Reach

Partnering with PPOB can open opportunities to reach a wider market, especially in areas that are not yet served by conventional banking services.

How to Start a PPOB Business

To start a PPOB business, the main requirements are a stable internet connection, a printer, and a laptop or smartphone. You can operate your business from anywhere, including your home, as anyone can be your customer—even neighbors who are likely to make at least one transaction per month.

Once all the above preparations are in place, here are the steps you need to follow to start a PPOB business.

1. Find a Credible Vendor

Today, there are many PPOB vendors available with similar features and workflows. However, you should be selective in choosing a reputable PPOB vendor to avoid unwanted risks, such as unpaid bills.

In addition to evaluating each vendor’s strengths, weaknesses, and track record, you should also seek recommendations from people around you or check online reviews from their users.

2. Prepare a Balance as Initial Capital

As mentioned earlier, a PPOB business heavily relies on the balance you deposit to pay all customer bills. If your balance runs out, customers won’t be able to make payments through you.

The initial deposit typically required is around 5 million rupiah. However, you can start by loading the minimum required balance first. Once your business is running and profits become visible, you can increase your balance through top-ups.

3. Don’t Forget Promotion: What Is PPOB?

Although many people use it, there are still those who may not know about it. Therefore, don’t forget to promote your services by letting your neighbors, family, friends, colleagues, and others know that you are now a PPOB partner. Inform them about the types of payments they can make through you.

Since PPOB operates nationwide, you can also reach a wider market. Promote your services on social media platforms like Instagram, Facebook, and X to increase your chances of success.

4. Offer Various Payment Options

Although most people still prefer to pay in cash, it’s better if you can offer various payment options from different financial products. This gives customers more choices when paying, enhancing their convenience and satisfaction.

Now that you know what PPOB is, it’s time to start your business. If you want to ask questions or share ideas with fellow PPOB business partners, you can join LabamuHub from Labamu. Here, many entrepreneurs from various industries come together to support each other.

This business community is designed to provide connections and collaboration with the goal of #GrowTogether, allowing entrepreneurs from various sectors to expand their businesses and go digital. One of the programs offered is Branding & Socialization, which can help make your business more recognized and trusted by customers.

So, what are you waiting for? Join LabamuHub from Labamu today!