Know Your Customer (KYC): An Essential Process for Identification and Verification—Here’s Why It Matters!

July 7, 2025

Share This Article

In the world of digital business, one of the key elements in identifying and mitigating the risks of fraud and financial crime is Know Your Customer (KYC).

Conducting KYC checks is essential for the safety and security of your business, and it ensures that you remain compliant with applicable laws and regulations.

If you're not yet familiar with what KYC is and why it’s important for your business, read this article to the end for a complete explanation.

Definition of Know Your Customer (KYC)

Know Your Customer atau KYC mengacu pada kerangka kerja untuk memverifikasi identitas pelanggan, menilai profil risiko mereka, dan memahami sifat dan tujuan aktivitas keuangan mereka.

KYC sendiri menjadi praktik regulasi wajib bagi lembaga keuangan seperti bank, pialang, dan perusahaan investasi. Sementara Industri tertentu lainnya mungkin juga tunduk pada persyaratan KYC tergantung pada yurisdiksinya.

KYC biasanya melibatkan beberapa prosedur, seperti Customer Identification Program (CIP), Customer Due Diligence (CDD), dan pemantauan berkelanjutan atau Enhanced Due Diligence (EDD).

1. Customer Identification Program (CIP)

The Customer Identification Program (CIP) is designed to ensure that only legitimate customers can access services. For individual clients, there are four key pieces of identifying information typically required:

Full name

Date of birth

Residential or business address

Identification number from a government-issued ID (e.g., national ID card, driver’s license, or passport)

Companies must then verify this information using risk-based procedures, which may include requesting additional documentation.

For corporate clients, institutions may require documents such as a business registration certificate to verify the entity's legal name, address, and ownership or control structure.

In addition to document-based methods, many institutions also rely on non-documentary verification, such as direct contact or cross-checking information against government lists and public databases.

2. Customer Due Diligence (CDD)

4 Key Reasons Why KYC Is So Important

1. Protecting Data and Transaction Security

By implementing KYC, service providers can ensure that accounts are genuinely owned by verified individuals. This verification helps protect users’ personal data from identity theft or unauthorized access.

In addition, KYC strengthens the security of financial transactions by enabling systems to detect suspicious activity early on.

Without KYC, digital platforms become more vulnerable to hacking, account abuse, and fraudulent practices that could harm users.

2. KYC as a Form of Compliance with OJK and the Personal Data Protection Law

KYC is not only about technical security—it’s also a legal requirement in Indonesia.

The Financial Services Authority (OJK) mandates that financial institutions and digital service providers carry out KYC as part of good governance and responsible business practices.

At the same time, the Personal Data Protection Law (UU PDP) requires companies to manage personal data lawfully, transparently, and securely.

Therefore, KYC is a necessary first step to ensure user data collection is done correctly and in compliance with the law.

3. Preventing Fraud and Account Misuse

KYC plays a crucial role in preventing digital crimes such as identity fraud, money laundering, and fake account creation. Through thorough verification, platforms can screen out users who may pose security risks or have criminal intent.

In case of violations, the system can more easily track the perpetrators thanks to the documented identity data. This also adds an extra layer of protection for other users against potential misuse.

4. Unlocking Access to More Features and Services

One of the practical benefits of completing KYC is access to more comprehensive and flexible features.

Verified users often enjoy higher transaction limits, faster withdrawals and deposits, and access to premium services.

This serves as an incentive for users to complete the verification process and build a more secure, trustworthy relationship with the platform.

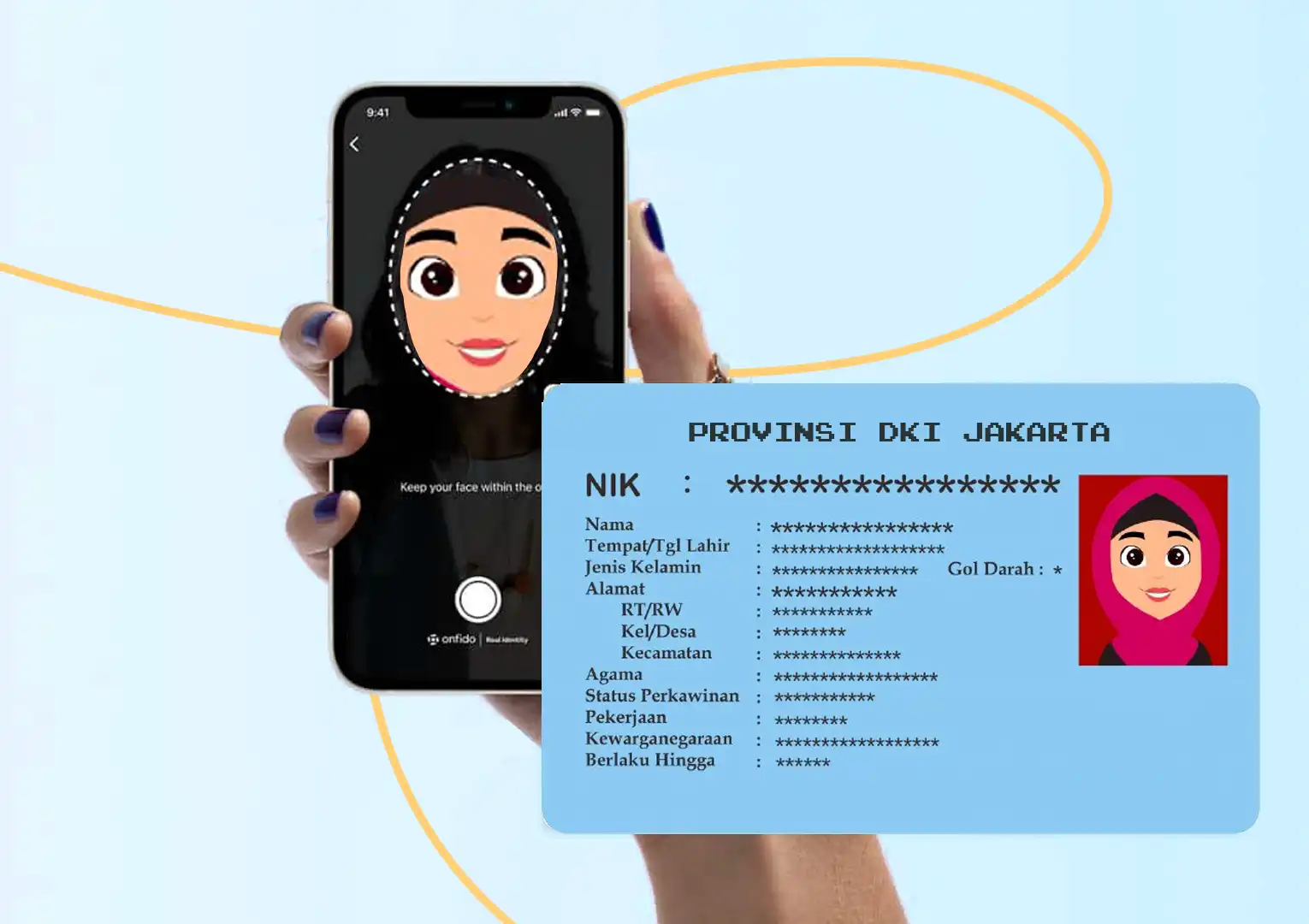

KYC Process in the Labamu App

To get verified and unlock all features in the Labamu app, here are the steps you need to follow:

Prepare your e-KTP (Indonesian National ID) and click “Start Account Verification.”

Get ready to take a selfie. Make sure you're in a well-lit room.

Take a clear photo of your face, looking straight at the camera without any accessories.

Review the selfie photo. Click “Next” to proceed.

Prepare your e-KTP. For the best result, place it on a flat surface.

Take a photo of your e-KTP, making sure it’s within the frame and not cropped.

Once your e-KTP photo is processed, confirm and complete your personal data based on your ID, then click “Continue.”

Don’t forget to fill in your business information, then click “Continue.”

Complete any additional supporting data, then click “Continue.”

Review and confirm all the data you’ve submitted. Once everything is correct, click “Submit.”

Your data has been submitted and is being processed. Once verification is successful, you can start using Labamu right away!

Benefits of a Verified Labamu Account

Once your Labamu account is verified through the KYC process, you’ll gain access to several key features:

Withdraw and transfer funds

Register for and use QRIS for business transactions

Avoid limitations on withdrawal features within the app

That’s a complete explanation of Know Your Customer (KYC). While it may not be mandatory, it’s highly recommended to complete your Labamu account verification for your own protection—and to enjoy a safer, more seamless digital experience.

With a verified account, you can freely use all of Labamu’s powerful features—from POS Kasir, Digital Products, QR Menu, Order Management, to tools for smooth business operations like Labamu Staff, Reports, and Account Bookkeeping.

So don’t wait—verify your Labamu account today and make the most of everything the app has to offer!